Brand new 31-12 months, fixed-rate financial is among the most common mortgage throughout the U.S. Centered on Freddie Mac, almost ninety% off Western homeowners features a thirty-year, fixed-rate loan. But not, because the 31-seasons home loan are prominent doesn’t mean it will always be the latest best one for you!

Let’s speak about fifteen-12 months in place of 31-season mortgages, and how they may be able impact the size of the monthly payment, plus the number of attention you’ll shell out along the longevity of the mortgage.

So what does an excellent 15-Year or 30-Year Financial Indicate?

15-12 months and 31-year mortgage loans consider new loan’s label-which is, what number of age you will need to pay off the cash you lent to invest in your home. By using away an excellent 15-year mortgage, the mortgage have to be reduced over a period of 15 years. When you have a thirty-12 months financing, you’ll need to pay it off over a period of three decades. Additionally, you will have to pay the notice you borrowed from from the the termination of the newest loan’s name.

Which are the Benefits associated with an effective fifteen-Year Mortgage?

An excellent fifteen-12 months mortgage has many advantages. 15-12 months mortgage loans normally have lower interest rates and help it can save you money on attract if you are paying out of the home loan faster. You could fundamentally build your residence’s equity faster and you can repay their financial quicker with a 15-seasons loan, as well.

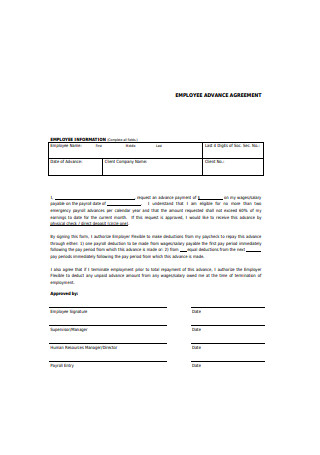

Brand new drawback out-of fifteen-year mortgages is that they usually include a top lowest monthly payment. You will be needed to pay far more monthly having a good 15-12 months home loan than simply you are required to spend having a good 30-seasons home loan having credit the same amount of money. (How much money you borrow is commonly called the mortgage principal.) Check both of these sample calculations:

Clearly within these examples, the newest 15-12 months financial you will help save you more $40,000 for the desire repayments however, require you to spend a whole lot more each month. Check out our 15- compared to. 30-Season Mortgage Calculator to customize their quotes to own attention and month-to-month repayments.

What are the Advantages of a 30-12 months Mortgage?

The key advantage of a 30-year mortgage is the straight down minimum monthly payment this type of money need. Perhaps you have realized about analogy over, the new 31-season home loan requires that spend a small over $900 less each month, compared to the fifteen-year home loan. This may create purchasing property more affordable and provide you with a great deal more self-reliance on your monthly budget for almost every other expense and you may expenses.

For this down payment, you will generally shell out a high rate of interest and shell out so much more profit notice along the longevity of payday loans online Alabama the loan than just you manage having a beneficial fifteen-year financial.

Is it possible you Generate Additional Money to the a 30-Seasons Home loan?

Yes. Extremely lenders makes it possible to outlay cash way more every month compared to minimal required. This is why you can aquire a 30-seasons home loan however, pay it off because if it was good 15-12 months financial. The advantage of this might be autonomy. You might spend $600 a lot more a month, $3 hundred more the second week, and absolutely nothing extra the third day.

Of numerous people including the satisfaction away from understanding they have the option of investing much more every month or perhaps not, in the place of being closed on always making the large payment. A reduced percentage normally get-off more cash on your own plan for most other expense, help save you to have emergency expenses instance an urgent house repair, help you save getting college otherwise old age, and.

Might typically spend extra cash for the interest by making most money towards the a thirty-12 months home loan than simply through getting good fifteen-year home loan but those individuals most home loan repayments have a tendency to however help you save cash in desire!

Do you really Refinance a thirty-Year Mortgage on a good 15-Year Financial?

Yes. You could generally speaking favor an effective 15-year home loan term when you re-finance. Property owners often refinance away from a thirty-12 months so you’re able to a beneficial fifteen-12 months loan whenever the income have left upwards, and also the highest lowest monthly obligations be affordable. You could potentially constantly generate more mortgage repayments for the 15-12 months mortgage loans, too.

Is good fifteen-Seasons or 31-Year Home loan Best for you?

You’ll want to glance at the large image of your bank account, including your homeloan payment, other debts, costs, offers, and you will month-to-month earnings when you are determining anywhere between an effective 15-year and you may 29-12 months home loan. In particular, remember whether or not less monthly payment or saving cash from inside the desire through the years is much more vital that you you right now.

Independence Financial is not an economic mentor. The latest facts outlined a lot more than was getting informational intentions only and generally are perhaps not money or monetary recommendations. Consult a monetary coach before you make extremely important individual economic conclusion, and you can demand an income tax mentor for facts about the fresh new deductibility from desire and you can charge.

+ There are no comments

Add yours