The fresh new meteoric growth of Skyrocket Financial have demonstrated what financing officials should do to continue becoming aggressive about marketplace from the next day. The clear answer? Embrace a hybrid mortgage financing procedure.

A crossbreed mortgage strategy integrates the traditional, relationship-heavier, credit procedure that have modern technology intended for boosting and you may streamlining brand new procedure. Below, we shall direct you ideas on how to get it done.

These were the text out of Quicken Loans’ captain economist, Bob Walters. Even though Quicken Fund / Skyrocket Home loan began $79 billion in 2015 home loan frequency, we think the brand new character of financing manager isn’t passing away, however it certainly needs to progress.

The draw to Rocket Mortgage: financial automation

See within lines and is also obvious just what Really pushes its mortgage financing power: automation and you may results.

The outcomes was impractical to skip. Nonbank loan providers, eg Quicken Finance, have seen its show of your home-based mortgage , these nonbank lenders began 23% of the domestic mortgage one amount had grown so you can 43%.

They’ve got developed a system which makes it simple for a potential borrower to submit this new records necessary to get a keen underwriting decision. Income, assets, debts, fico scores, and stuff like that are immediately pulled towards the program when you’re cutting-edge algorithms work behind-the-scenes to create a collection of financing selection.

Automated file and you can resource recovery alone is a big mark (read: time-saver) getting consumers, nonetheless also add to your certain nice has eg eSignature and customized pre-approval letters for individuals.

Difficulties with Rocket Home loan: shortage of service and you may financial expertise

Consider this scenario: you will get willing to pick property, you create the Quicken Funds account, enter yours advice and eliminate your entire income and you may possessions on system and you may voila you’ve got certain mortgage information.

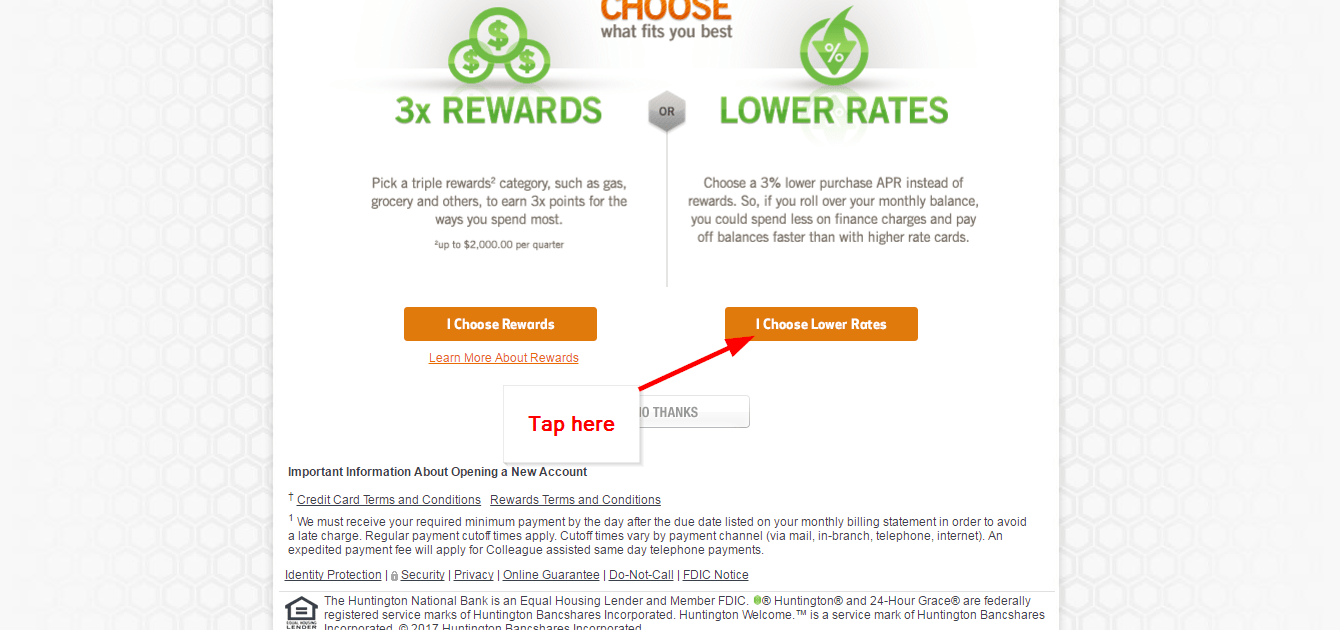

Today the enjoyment begins! Having Rocket Mortgage, the consumer is personalize the loan choice by the adjusting slider pubs for things such as closing costs, loan words and you may interest rates.

This is so enjoyable! You will find had my personal finest mortgage options, now i’d like to strike the See if I’m Approved button aaaaaaaannnnd: Declined.

Truly the only option here is in order browse around this website to mouse click a unique button to talk to a trip-cardio mortgage broker exactly who, lacking the knowledge of things about the borrower, will try to determine how it happened. Such to have timely and you can productive.

For anyone and also make what exactly is potentially the biggest acquisition of its lives, this is just maybe not appropriate. The difficulties occurring listed below are just what fast the need for a great crossbreed mortgage procedure.

So it call center along with might attempting to fill the fresh character your mortgage officer has actually for the a traditional setting: pointers and you can suggestions during the an intricate and you may mental exchange, answers if you want them, experience in brand new underwriting requirements needed to get loan accepted, therefore the follow-as a consequence of necessary to allow you to be closing.

The mortgage officer is even a member of your own society. They may be able make tips about regional Realtors, when to re-finance, or help you with property guarantee otherwise HELOC (things Quicken/Skyrocket does not give) when the date excellent.

Incorporating technology toward a crossbreed home loan process

The primary should be to study on new sessions instructed from the consumers because of their access to Skyrocket Home loan: individuals wanted a simplified and you may streamlined processes, with much easier usage of pointers, and you will today’s technology from the its fingertips.

These are functions you to financing officer Also have, on the proper options set up, whilst including immense worth regarding a 1:step 1 connection with individuals.

The purpose-of-purchases

New POS is a fantastic example of advantages good LO can also be experience by adding advanced technical into their origination process. The current mortgage section-of-marketing has got the scientific efficiencies and you may mobile-friendly feel you to consumers appeal:

- User-friendly and you may safer site to help you streamline document range.

- Integrated functions to have purchasing lead-provider borrowing, assets/deposits, a position, and you may money verifications.

- Automatic financing condition reputation to save consumers advised regarding the entire procedure.

- eSignature.

- Guided, interview-concept loan application.

- Cellular app w/ images upload opportunities.

Besides really does the brand new POS program do-all with the getting the brand new borrower, however the tangible advantage to the borrowed funds inventor lets them to score that loan file for the underwriting faster, with high number of reliability. All of this conspires to each other to greatly help score finance funded shorter and you can convenient than just via history processes.

This might be the consumers are incredibly asking for, and why they usually have turned to the fresh new Quicken Loans’ / Skyrocket Mortgages worldwide. The stress is placed with the efficiency and you can visibility.

The bottom line

You don’t want to end up being Rocket Financial. The intention of Rocket Mortgage is to fundamentally get rid of the mortgage manager regarding mortgage origination process. Although not, it is impossible to disregard the organization out-of nonbank loan providers eg Quicken Money. You to definitely gains increase provides demonstrated new advice the consumer was demanding your industry disperse: pass.

Into introduction of new development and you will programs eg Fannie Mae’s Day 1 Confidence, it is sure if a has actually read the brand new alerting bells noisy and you can obvious. You ought to evolve, or else you will feel passed by the group.

+ There are no comments

Add yours