Interest rates was indeed rising prior to now couple of years – towards handmade cards, mortgage loans, and other lending products like domestic guarantee money and you can home guarantee personal lines of credit .

However, that doesn’t mean these items is necessarily bad records now. Actually, for most home owners, taking out property collateral mortgage in today’s market may actually feel a sensible disperse.

So is this a good time to obtain a property collateral financing? Benefits weighin

Here is what experts must state throughout the whether this is actually the right time to obtain property guarantee financing.

Sure… because the household security features almost certainly maxed away

“If you’ve had your house for most years and its worth has increased since your purchase, you have in all probability established-upwards security,” states Hazel Secco, chairman of Fall into line Economic Solutions into the Hoboken, N.J. “Which improved family well worth brings a solid basis for protecting a house equity financing.”

Nonetheless, you to large chunk regarding collateral may well not continue for much time. With a high mortgage cost driving down consumer consult, home values – and you will, by expansion, family guarantee – you are going to fall, as well. This means might have to act in the near future when planning on taking advantageous asset of the security within their fullest.

“For somebody seeking tap household guarantee, now’s a great time to seem involved with it, given that home values might not rating best for the near future,” states Michael Micheletti, head sales officer home collateral trader Unlock.

Home security loans aren’t sensible in the event that you’ll need to sell the house in the future, as if your property drops during the well worth ranging from now and then, it could “bring about a situation called being under water,” Secco claims, “where outstanding mortgage balance exceeds the house’s current market really worth.”

If you are under water on your financial, offering your property would not websites your enough to pay back your money, and you might end owing your mortgage brokers towards the remaining outstanding balance.

In the event the all you have to pay to have – home solutions, scientific expenses, or other expenses – is actually inevitable and you can would otherwise go on credit cards, personal loan, or another variety of higher-interest personal debt, a property equity loan is likely a better alternatives. Since the Secco sets they, “Other loan interest rates aren’t really appealing at the moment.”

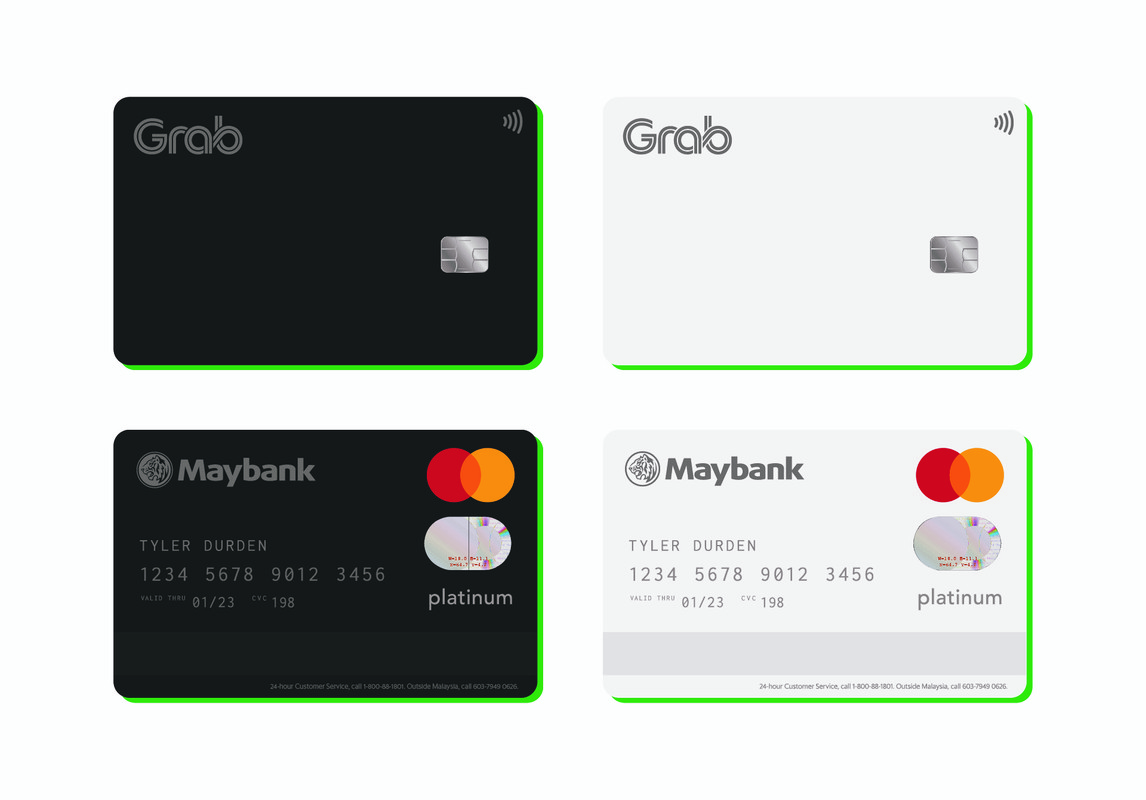

This woman is proper: The typical credit card rate is over 21% now, versus 8 so you can ten% discover towards the property security mortgage. Personal bank loan costs has topped twelve%.

“It’s the even more economically beneficial choice versus taking out fully good personal bank loan otherwise counting on mastercard borrowing from the bank,” Secco claims.

Zero… in the event your credit’s maybe not high

Just as in very borrowing products, your credit score performs a huge role in not merely being qualified to have a home security financing – exactly what interest you earn on a single, as well. Just in case your credit score is actually lower, you’re likely to get a higher level (and you will after that, a top monthly payment, too).

“In the event that another person’s borrowing from the bank doesn’t meet the requirements all of them to discover the best speed, costs are too high for the homeowner’s funds,” Micheletti says. “We have been seeing a lot more borrowing from the bank firming today, also, which makes it more complicated to possess property owners to help you be eligible for mortgage products and to discover the best cost.”

You could potentially usually check your rating using your bank otherwise credit https://paydayloanalabama.com/carlisle-rockledge/ card issuer. To find the lowest rates, you’ll generally want a beneficial 760 credit history or maybe more.

Yes… for those who have enough high-attention loans

As household security funds keeps down interest rates than many other financial issues, they are able to continually be a good idea to own consolidating personal debt. If you had $ten,000 toward a charge card having good 21% rates, like, playing with an enthusiastic 8% house equity loan to repay that equilibrium will save you a tremendous amount from inside the interest will set you back.

Credit card rates try variable, as well, which means that your prices and you may costs can rise. Family collateral funds never have so it exposure.

“Household guarantee loans offer repaired rates of interest,” Micheletti says, “to be certain residents its speed doesn’t rise into the name away from the loan.”

Zero… in case your earnings is unstable

Eventually, when you yourself have volatile money and you will aren’t sure you could potentially easily take on the next payment per month, property security loan most likely isn’t the best flow.

Because Micheletti sets they, “There can be a threat of putting their property on the foreclosures should they miss payments towards the mortgage.”

Research rates for your home equity financing

You can purchase a home security mortgage or HELOC off many banking companies, borrowing from the bank unions and lenders. To ensure you’ll receive an informed rate , constantly contrast at the very least several options.

View fees and you may settlement costs, also, and become careful to simply obtain what you would like. Borrowing too-much could lead to unnecessarily highest payments, hence develops their risk of foreclosure.

+ There are no comments

Add yours