Mobile, are designed, and you can standard property was well-known choices for buyers searching for this new small household direction and the ones struggling to be able to get an excellent conventional household. In the event that this type of unconventional homes attract you, it is possible to obtain a mortgage buying one. not, the latest catch would be the fact of a lot loan providers might require one to individual or find the home and forever add your residence in order to it to help you qualify for a traditional home loan.

Secret Takeaways

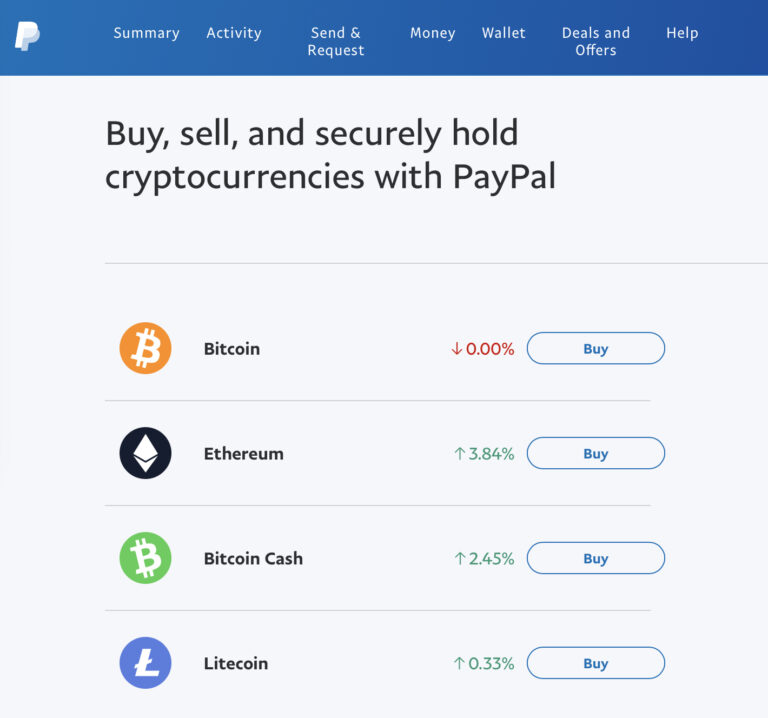

- Mobile, are designed, and you will standard homes possess numerous money available options.

- Financing will be available through the brand, local borrowing unions, otherwise specialization loan providers.

- Loan choice particularly You.S. Institution of Experts Facts (VA) funds, You.S. Service of Farming (USDA) money, and Federal Houses Administration (FHA) funds come on are made residential property.

- You can utilize a mortgage buying both a mobile, are designed, or modular home and home meanwhile.

- Many individuals sign up for chattel funds, which might be more expensive than just a mortgage.

Type of Mobile Land

The phrase cellular house applies to many types of residential property that are not commercially mobile. There’s two almost every other subcategories: are made house and standard belongings.

Mobile Homes

It’s cellular property was mobile. Lightweight house, travelling trailers where anyone real time, and you may converted vehicles are all officially mobile belongings. Structures that were factory-centered before U.S. Service of Construction and Urban Creativity (HUD) code conditions was indeed established in 1976 was cellular land. Manufactured house oriented shortly after criteria were launched are merely are created home as much as HUD and more than lenders are concerned, but anyone nonetheless call them cellular land.

Are produced House

Are produced land are those mostly also known as cellular home. They are land come up with when you look at the a manufacturing plant following apply a great deal. They usually are forever affixed to a single location using some base, mostly a beneficial slab. Whenever you are are formulated belongings can officially getting gone from 1 location internet to a new, its frequently rates-expensive.

Modular Residential property

If you have ever already been caught inside visitors at the rear of exactly what turns out a house cut-in 1 / 2 of, then you’ve got viewed a modular family. Standard belongings are still residential property which might be produced in other areas and built on-webpages. Yet not, these were much bigger models compared to the standard are formulated domestic and frequently were second reports, garages, secure patios-and you will, in some cases, basement.

Never ever deal with that loan promote in advance of contrasting your choices, particularly if you happen to be putting the home with the an article of possessions you own.

Analytics to the Are created Land

Are produced land take into account 6% of all the occupied property however, a much smaller percentage of house loan originations, considering a study issued by the User Economic Defense Agency (CFPB). All you call them, a primary reason loan originations are so low is the fact individuals located in manufactured belongings tend to be financially vulnerable, given that CFPB sets they-the elderly otherwise some one whose self-said profits was basically from the lower money class and you will who are most likely is considering shorter-than-positive prices and you can terms and conditions to the people mortgage.

With respect to the CFPB, regarding 32% of domiciles staying in a produced family try went of the good retiree. He’s got about you to-quarter of your own average websites worth of most other houses. Were created homes aren’t usually entitled to a conventional home loan since prospective citizen cannot individual the brand new land about what he is discover.

Before you take out a loan towards the a made home, it is important to discover the options and make sure which you make an application for the most positive variety of money.

Financing Selection

There had been to start with merely two types of are formulated home financing: a traditional home loan and you will good chattel home loan. Given that are designed family community changed across the years, alot more choices are very available. Traditional financial alternatives has built-within the defenses as much as foreclosures, closure disclosures towards the financing terms and conditions, and so on. They also render way more advantageous rates.

+ There are no comments

Add yours