Once you’ve had your residence financing for a time, you might find that you want additional money with other one thing. This is how home financing improve will come in.

For those who have adequate security, really mortgage lenders assists you to increase your home loan to cover anything else. This could be titled good “top-up” and you will allows you to acquire extra finance against the security you have of your home. After that you can utilize this equity to fund anything else. Particular explanations property owners do that include:

- To find other property to make use of since a good investment

- Renovations because of their latest property

- Combining expenses

- Highest instructions like a holiday otherwise automobile

How come they work?

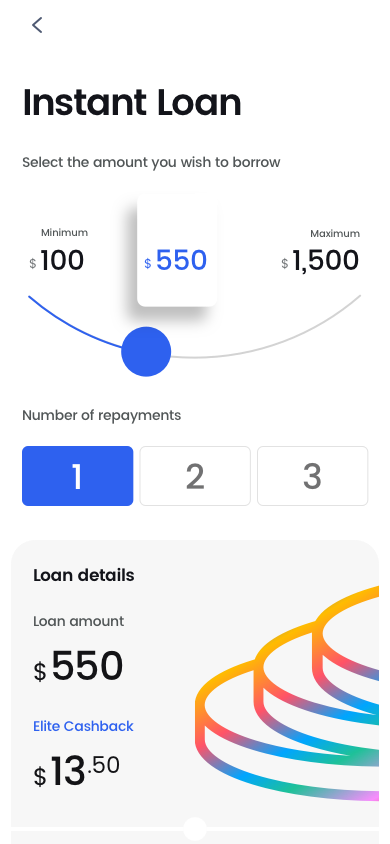

It is a feasible option for you aren’t a current mortgage who has security. Collateral could have collected from the contributing a large amount of your deals initial after you ordered the house or property, or you could have paid off the loan off, or even the property value your property ount it is possible to acquire is determined by simply how much guarantee can be obtained since well since your individual financial predicament.

A button part of the process are determining simply how much guarantee you really have. This is certainly influenced by acquiring the bank to complete an effective valuation done at your residence. payday loan Tashua The financial institution will has an upwards-to-time value to work out how much you may be ready to get into.

Basically, you could simply boost your loan around 80% of one’s property value the house as opposed to taking on home loan insurance policies, otherwise to 90% while ready to spend mortgage insurance rates.

To locate a concept of exactly how much your house is value, you may have to search. Brand new 100 % free Assets Report about our very own website is a great starting section. This may give you possessions speed research for the suburb since well because a great amount of recent conversion. Look for marketed characteristics with parallels toward very own provide you a concept of your property’s really worth.

In case the financing is already with , we would be capable of getting a keen RP Data overview of your residence, that can provide a quotation of the well worth. Name our Financing Specialist to your 1800 111 001 to talk about which option.

When you find yourself in search of taking right out even more funds facing your mortgage, speak with the lender in regards to the selection that are available. Based the lender, they could fees an establishment payment to afford will set you back in it.

After you apply, the financial may do an equivalent comparison as you had been obtaining a different sort of mortgage to make sure you’re able to handle the increase in the repayments. If you’re planning to boost your residence mortgage, you will need to cure any established personal debt as frequently as you are able to.

Experts

- It does continually be less expensive than taking out a consumer loan otherwise car finance, because so many mortgage rates of interest was all the way down.

- You would not spend appeal on the mortgage boost if you don’t in reality draw the money to utilize.

- You will simply have one repayment to help you juggle rather than several bills with assorted payments.

Downfalls

The only is that you was placing on your own from inside the after that financial obligation. You should be seeking to pay your home financing out of, not broadening it.

Secondly, a mortgage is spread-over a long time, very although the interest rate was less expensive than an automobile mortgage, only paying the lowest form you are purchasing so much more in attention and you may spreading the expense of the vehicle over to the brand new remaining title of one’s financing, and this can be 20 to help you 30 years.

One of the keys is to has a strategy. Ensure you get your mortgage lender so you can assess how much cash additional you’ll need to pay with every payment to invest the increased amount from inside a certain name. A motor vehicle, such as for instance, is five years. You might like to have the boost put in a different sort of sub membership or separated you continue concerned about spending it from rapidly. Like that, once you’ve paid off the increase, you are to focusing on settling the brand spanking new financing amount.

Before you can most readily useful up your home loan, think about your finances now and you can on the tune to help you allow your best option to you personally. Whether your pick could be used regarding, up coming rescuing the cash ahead of time and keeping they inside an offset membership are a level more sensible choice.

+ There are no comments

Add yours