When you refinance the home loan after forbearance, you are taking to your another type of mortgage

The COVID-19 pandemic brought about many Us americans to play pecuniary hardship. Consequently, particular property owners haven’t been capable keep up with their mortgage costs. To add some save, the us government provided home financing forbearance plan on CARES Act getting federally supported mortgages. It provides homeowners the capability to stop otherwise clean out its financial repayments.

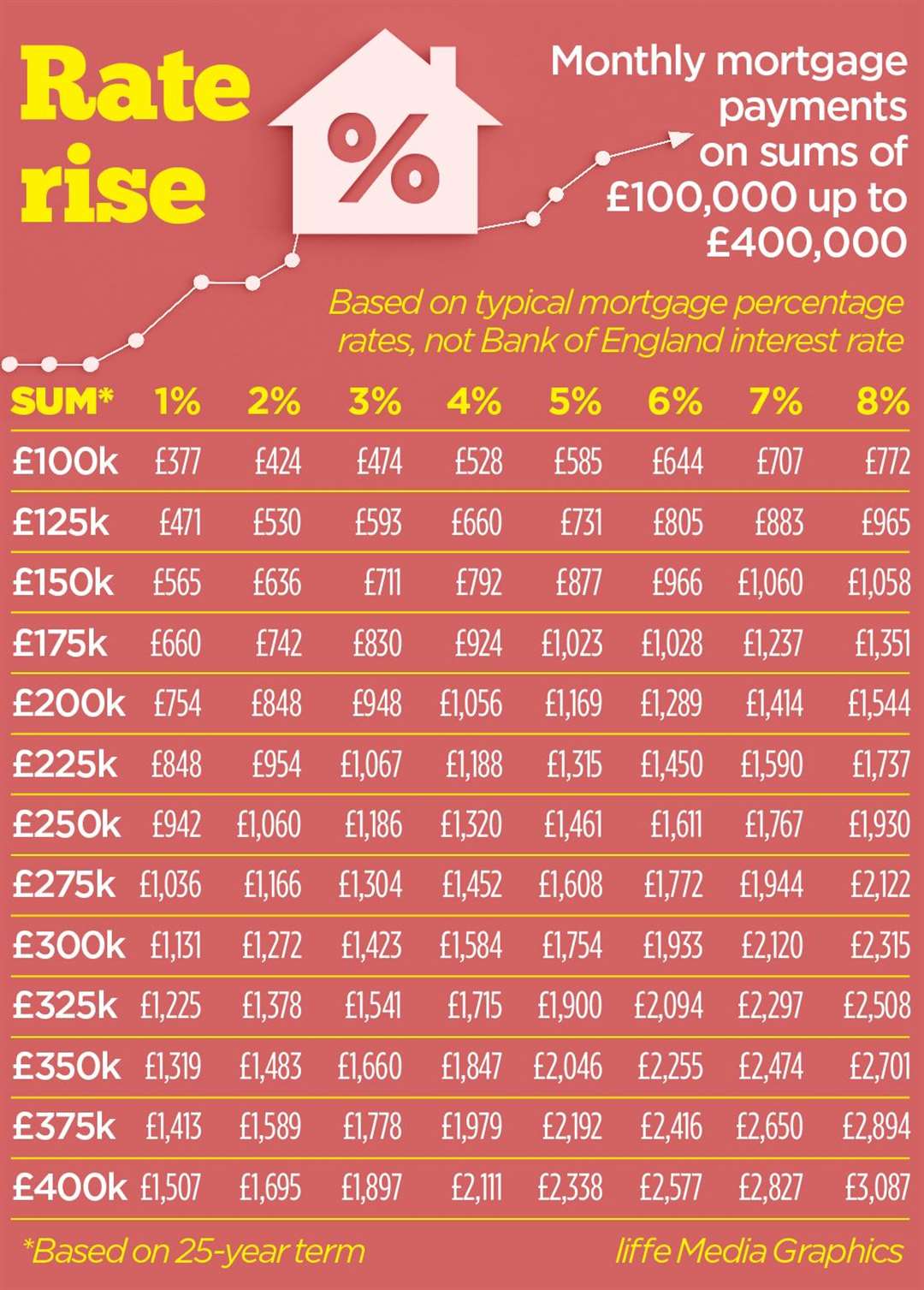

Although the number of fund from inside the forbearance has actually dropped recently, dos.step 3 million residents stay-in forbearance preparations, with respect to the Mortgage Lenders Connection. Individuals which no longer need this protection should re-finance the mortgage shortly after forbearance for taking advantage of listing lower refi prices. These lower mortgage costs has actually driven an increase within the home loan re-finance interest for the past year, including significantly more need for taking out fully a consumer loan, household security financing, education loan and more.

When you find yourself ready to benefit from all the way down rates otherwise is actually even considering creating home financing refinance, visit Reliable to obtain prequalified rates instead of affecting your credit rating.

Government mortgage forbearance already expires toward . Inside the February, President Joe Biden extended new forbearance for government mortgages to simply help Americans who will be nevertheless experience monetaray hardship on account of COVID-19. The length of time it requires one to getting qualified to receive a mortgage refinance shortly after forbearance relies upon the lending company, the type of home mortgage and you may whether or not you went on making costs. While most loan providers wouldn’t enable you to refinance up to one year immediately following forbearance, you’ll meet the requirements in the course of time with a few loan providers.

Instance, last Could possibly get, the latest Government Houses Funds Institution provided pointers stating borrowers who had been latest on their mortgages you will be considered instantly to possess a beneficial re-finance. So you’re able to qualify or even, might need certainly to wait 90 days while making three costs during the a-row beneath your installment package.

If you’re considering refinancing your own home loan just after forbearance, play with Credible’s online product to get into mortgage possibilities round the several loan providers with a lot fewer forms so you’re able to fill in.

Once you prequalify, the lending company will provide you with a quote off exacltly what the re-finance speed and terms could well be

In advance of refinancing your mortgage, you will understand the benefits and you may downsides of using this method. Such as for example, refinancing the loan is also reduce your payment it can also be may also increase the amount of interest you pay for those who offer the borrowed funds terms and conditions. As well as, refinancing the loan may well not add up if you intend toward moving in the near future.

Refinancing off a 30-seasons fixed home loan to good fifteen-year repaired financial helps you pay off their home loan less. That one, although not, always comes with highest payment per month.

Talking to the lender helps you know what the loan options are, how to get a reduced payment and also the expenses associated with a home loan refinance. When you have questions relating to your refinancing options, visit Reputable to access a home loan refinance calculator and possess their mortgage concerns answered.

Additional loan providers possess various other refinance pricing. To discover the lower rates you’re entitled to, you ought to prequalify which have numerous loan providers.

When a mortgage lender viewpoints your application, they’re going to remark your credit score to help understand what your re-finance speed is. The lower prices always look at the consumers with higher level borrowing from the bank score – no less than a great 740, in accordance with the FICO credit reporting model.

You should buy a free of charge content of one’s statement all the twelve weeks away from the about three credit reporting agencies: Transunion, Experian and you may Equifax. One good way to increase a poor credit rating will be to disagreement and take away incorrect or incomplete information from your credit file. Other ways adjust their poor credit score become not lost home financing fee and you will repaying the debt.

- Selection of obligations

- Listing of possessions

- Two months off shell out stubs

- Two years value of taxation statements, W2s and you may 1099s

- A duplicate of the homeowner’s loans Woody Creek Colorado insurance plan

- A duplicate of your term insurance policies

When you are recognized to your the new mortgage, the lending company will be sending you particular files to help you sign. This might be called the closing or settlement several months. Once you signal the fresh new documentation, the lender have a tendency to distributed the amount of money, and you will be responsible for repaying the loan like magic.

- Government-issued Photographs ID

- A duplicate of your homeowner’s insurance

- A good cashier’s check to pay for their settlement costs

As Americans emerge from forbearance periods, refinancing their current mortgage could be a good way to continue to save money. By following the steps above, you can compare mortgage lenders and mortgage interest rates, ensuring refinancing is the right step for you and that you select the best refinance option. Visit Legitimate for connecting that have educated financing officials and get your mortgage questions answered.

+ There are no comments

Add yours