Personal mortgages are specially designed mortgage contracts which can be tend to focused at consumers one searching for a remedy that could perhaps not getting fixed thru normal financial procedures.

They may not be susceptible to an equivalent credit limitations since the antique mortgage organizations, allowing its lenders as alot more lenient.

You will find just how to receive one mortgage loans, how they perform, and also the benefits of viewing a professional before distribution a credit card applicatoin contained in this self-help guide to individual home loan capital.

Individual mortgages try an effective specialized sort of borrowing from the bank that’s available so you can website subscribers which have a need to see an immediate service due to a number of affairs and being rejected through regular banking channels otherwise dos nd level loan providers.

Individual loan providers commonly limited by an identical laws and regulations since finance companies, therefore such financing tends to be far more variable than an elementary home loan price.

Simply because they may possibly provide personalised mortgage loans into one basis, users frequently have accessibility now offers that aren’t available elsewhere, instance huge income multiples and you will unrestricted financing quantity.

You could find it difficult to locate these types of services without the aid from a great specialised advisor, simply because they certain loan providers exactly who promote personal funds just work via mortgage brokers.

Why pick these private financial money?

Personal home loan resource try a custom solution, plus the loan providers giving it capture high fulfillment inside the providing even more discretion and you can privacy.

Having access to individual financing

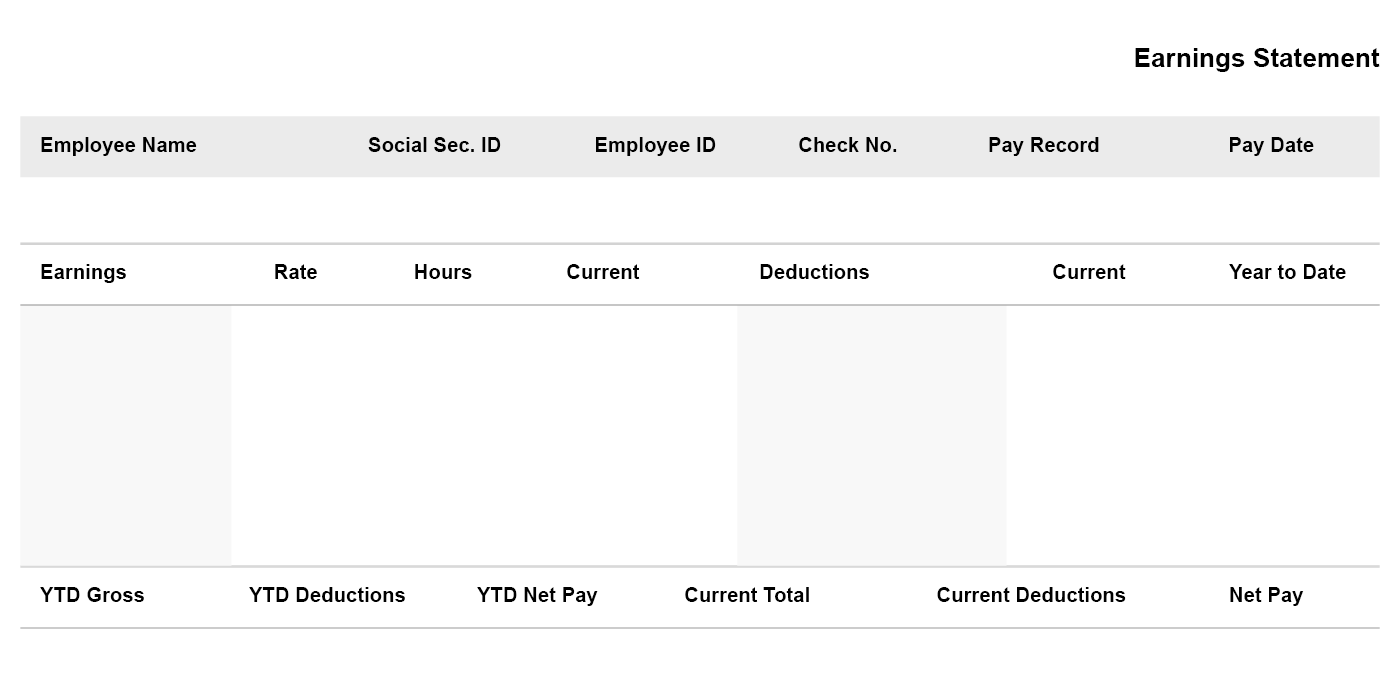

Compile your write-ups. You’ll need to provide proof your scenario and requires, and additionally a property and you may debts report. In addition, you will need the standard data files had a need to get a mortgage, along with character, home, and money dumps proofs.

Talk to a mortgage broker. Since most away from individual loan providers just sort out intermediaries, this step is generally a requirement if you need use of them. I interact with brokers just who desire in private resource, and they’ve got the fresh possibilities, experience, and you can involvement with support you in finding an informed bank. For individuals who call us having a question, we will supply you a totally free introduction to at least one of these professionals.

Allow your agent to manage this area! Once you have been paired with one, might hook up one to possible personal loan providers. One of the major advantages of using a brokerage for particularly that loan is they normally plan a customized plan for the your account and ensure that you receive an informed prices and you will conditions imaginable from that point.

Getting a second home loan

Including individual financing, next mortgages are generally handled a great deal more firmly than simply first mortgage loans. High rates, lower financing-to-really worth (LTV) percentages, and a lot more strict monetary fret examination you are going to originate from it. Your specific charge and you may terms might be determined toward a situation-by-case basis.

Personal fund having investment services

Mortgage loans to own resource services is actually a possibility and are also appraised likewise so you can antique mortgages getting money characteristics. Such mortgages are given to the a customised foundation, like private domestic mortgage loans, nevertheless brand of agreement you will end up considering relies upon the stability of your own funding as well as the projected local rental cash.

The level of leasing income you need is not ruled of the hardship advice, especially if you try protecting the loan which have assets.However, unless of course covered against an especially water investment including cash, put criteria may be higher than to possess private mortgage brokers, and that ordinarily have that loan-to-really worth proportion regarding ninety%.

Team mortgages

A corporate mortgage is also extracted from a personal lender. As a result of the both bespoke reputation out Maine title and loan of industrial investment preparations, personal lenders extremely account for an unusually tall part of the fresh industrial mortgage field.

The investment of some of one’s big commercial mortgage loans is frequently available with specialised personal loan providers; your own typical bank or borrowing commitment possess far less belly getting that sort of risk.

What the results are when you yourself have less than perfect credit?

It isn’t a deal-breaker as it may feel which have a traditional home loan. Just like the personal loan providers are way more concerned with the brand new guarantee assets and the total soundness of one’s app, financing criteria for individual mortgages is actually less restrictive than they are into high-street. Capable promote capital to help you website subscribers with all types regarding less than perfect credit, and they’re going to just be alarmed when your unfavorable immediately jeopardises the agreement.

However, when you yourself have extremely awful borrowing, the financial institution would ask you towards reasons why. In certain things, it will change the brand of package youre qualified to receive. For much more on this, please check our post on personal financing versus loans from banks and that may help you figure out which option is most effective for you.

Affect a personal mortgage advantages now

Although many of one’s lenders in this market only function with intermediaries, you should buy the help need now.

I lover with agents just who focus on private mortgage loans and highest online well worth finance as they have the specialised degree, sense, and you will financial connectivity you really need to get to the top personalised render.

Call us and we’ll strategy a free of charge, no-obligations fulfilling therefore we normally ideal direct you towards having the resource you require the most right now.

+ There are no comments

Add yours