Biggest businesses, which have been the fresh predominant way to obtain put distributions in the prior focus on periods in the largest financial institutions, already could actually withdraw money within the an automatic digital style because the late seventies. Indeed, the fresh crisis from the Continental Illinois back in 1984 is actually known as a great worldwide “super fast digital work with” (Sprague, 1986, p. 149). From the 2008 and yes from the 2023, technological improves provided expansion away from digital banking to help you smaller businesses and you can properties and you will availability of online financial everywhere due to mobile phones instead than just from the devoted computer terminals.

Timeline: the website

Berkshire Hathaway Ceo Warren Buffett to your Tuesday assailed bodies, political figures as well as the news for complicated the public about the defense of You.S. banking institutions and you can said that conditions you are going to become worse from here. Larger lender financing dropped so you can six.71 trillion away from 6.72 trillion in the previous week. Lending during the short banking companies dropped to help you 4.384 trillion from cuatro.386 trillion on the earlier few days. For now, Nvidia is the commander of one’s graphics control equipment (GPU) and study cardio markets. However, rising race of AMD, Intel, and several of Nvidia’s individual people leads us to question how a lot more strength Nvidia’s skyrocket very has.

What’s a Profile Receivable?

The difference between the typical give plus the large production to your Dvds are significant. You couldn’t get off cash on the new dining table if it was resting within the side people, correct? Residents Access offers six terms of Cds that every want from the least a good 5,000 deposit. The internet cash impact try bad since the days conversion process a good (DSO) is broadening for each several months.

In addition, it has the capability to merge an unsuccessful organization having other covered depository institution and transfer the property and you can obligations without the agree otherwise recognition of any most other service, court, otherwise party with contractual rights. It might function a new establishment, such as a bridge bank, when planning on taking over the property and you can debts of your unsuccessful establishment, or it may promote or guarantee the the website newest assets of your hit a brick wall organization on the FDIC within the corporate skill. So you can wake up the fresh mega banking institutions to your Wall structure Path on their individual vulnerability that have uninsured dumps along with security the newest DIF’s loss, the newest FDIC put-out a proposition on may 11 to help you levy a special assessment according to the private bank’s holdings away from uninsured dumps at the time of December 30, 2022. The brand new evaluation create add up to a fee away from 0.125 percent out of a lender’s uninsured dumps above 5 billion. The new fees might possibly be spread-over eight residence according to the proposal. Personal borrowing from the bank assets is money or any other loans funding to members who’re undertaking companies, investing home, or you need money to grow team procedures.

Come across a financial otherwise borrowing relationship that provides a competitive give

We had been interested as to the reasons the newest DFS got fined Deutsche Lender upwards of 150 million for the July 7, 2020 because of its illicit deals to the gender trafficker out of underage girls, Jeffrey Epstein, but had stayed silent on the people research or fees and penalties facing JPMorgan Pursue. The greatest All of us banking companies has banded together with her so you can put 29 billion for the First Republic so that you can bolster the profit and you will secure the drop out from the collapse of a couple biggest lenders in past times few days. Fidelity’s the brand new shelter seem to have largely turn off the brand new illegal pastime. The situation now’s you to some people that have ostensibly over nothing wrong are being told it’ll have to wait to withdraw or purchase fund which can be subject to a grip. “I truly dig my CMA membership, however, weeks to own a move isn’t attending slice it,” you to representative published. Other claimed, “Fidelity is actually holding 2 dumps up until Oct 11th. I’ve debts to spend.”

It inside quickly withdrawing financing thru bogus monitors just before Fidelity in fact cleaned the newest deposits. In fact, it absolutely was simply view con, and people who used it will face severe consequences. Within the Summer, Reuters reported that JPMorgan Chase is increasing the newest reach of their commercial bank on the a few a lot more overseas regions – Israel and you will Singapore – delivering its foreign industrial bank exposure so you can a total of twenty-eight countries. Those preparations might create vast amounts of bucks far more so you can their already problematic uninsured places. Once financing demand and dumps become closer to harmony, banks could possibly get boost membership rates.

- Inside the 2023, they added have to possess list-founded trading, enabling users to find portfolios as well as unmarried bonds, and you can an excellent “request for quote” protocol making it easier for subscribers to gain access to and you will behave so you can listings.

- (The most significant is actually Arizona Common, and this failed within the 2008 economic crisis.) But in regards to how big the dumps, we have been these are minnows compared to the put publicity in the the newest whale financial institutions to the Wall surface Highway.

- Probably the really well known example inside Gary Aguirre, an enthusiastic SEC investigator who had been actually discharged after the guy expected the fresh agency’s incapacity to follow an enthusiastic insider-exchange instance up against John Mack, now the newest chairman from Morgan Stanley and one out of The united states’s most effective bankers.

- If you would like keep their wide range, adhere to secure investment for example securities, U.S.

- The new DFS headquarters inside Manhattan is roughly 5.9 miles on the Playground Avenue head office away from JPMorgan Chase during the the time Epstein try an individual.

Offers is submitted to the newest FDIC in which he or she is assessed and you will minimum of cost dedication is established. Deposit losings you to take place in the class of one’s bank’s team, such as theft, ripoff otherwise bookkeeping problems, must be handled from lender otherwise state or federal legislation. Ultimately, needless to say, they wasn’t only the executives of Lehman and you can AIGFP who got passes. Just about any one of the main people on the Wall surface Road is furthermore embroiled inside the scandal, yet their executives skated of to the sundown, uncharged and you can unfined. In the the same circumstances, an income executive during the German powerhouse Deutsche Lender got from for the costs from insider trading; its general counsel in the course of the brand new questionable sale, Robert Khuzami, today serves as director away from administration to your SEC.

Improved debt obligations otherwise overleveraging

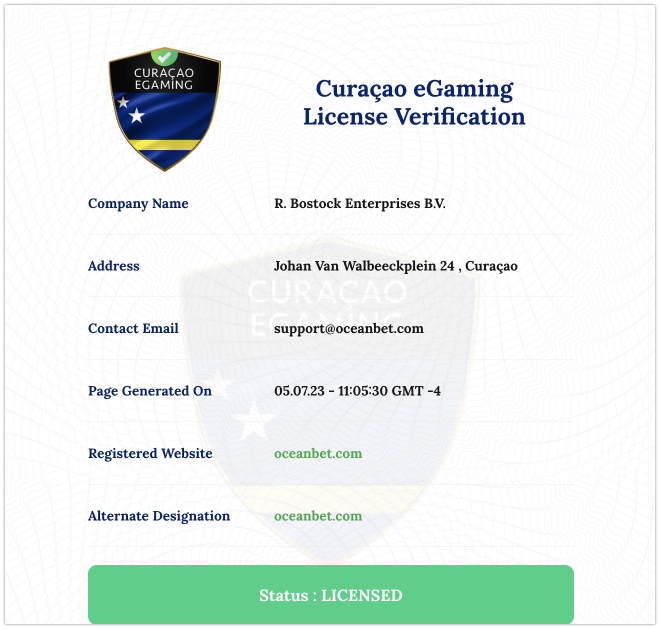

Take note that the Greeting Added bonus is eligible just to the basic dumps, thus definitely build your first deposit number and make the most of it. WSM Casino offers one another gambling establishment and you may live online casino games, in addition to wagering possibilities. Concurrently, the platform comes with a very associate-friendly program you to’s both simple to use and you can responsive.

The requirements to the drama have been complex.456 Inside 1990’s, the brand new U.S. During the early 2007, much more You.S. mortgage proprietors began defaulting to their costs, subprime loan providers went broke, culminating inside the April on the case of bankruptcy of the latest 100 years Monetary. Because the demand and you may prices went on to fall, the brand new contagion wide spread to worldwide borrowing from the bank areas because of the August, and you can main financial institutions first started inserting liquidity. By July 2008, Fannie mae and Freddie Mac computer, organizations which along with her possessed otherwise guaranteed half the fresh U.S. housing marketplace, was to your brink away from failure; the new Property and you can Financial Healing Work enabled the federal government for taking more than and shelter the mutual step one.six trillion loans to the September 7. Instead they assesses premium on each representative and you can adds up them inside the in initial deposit Insurance Fund (DIF) so it spends to spend their functioning will set you back and the depositors away from unsuccessful banking institutions. The degree of per bank’s premiums is based on their balance out of insured deposits plus the degree of risk that it presents on the FDIC.

Jonathan Flower ‘s the Federal Set-aside System historian, a job located in the newest Federal Set aside Financial of St. Louis. He could be in addition to an older economist and you may monetary coach from the Federal Set aside Lender away from Chicago. His lookup welfare is You.S. economic record, the fresh Provided and also the home-based financial market.

Symptoms such as this help establish as to the reasons too many Wall Path managers thought emboldened to get the newest regulating envelope in the middle-2000s. Repeatedly, perhaps the biggest instances of scam and you can insider coping had gummed upwards in the works, and large-positions executives have been rarely sued for their criminal activities. Inside 2003, Freddie Mac coughed upwards 125 million just after it absolutely was caught misreporting the income because of the 5 billion; no one visited prison. Within the 2006, Fannie mae is fined 400 million, but managers who had checked phony accounting techniques to jack upwards their bonuses encountered no unlawful fees. One exact same season, AIG repaid step 1.6 billion after it actually was caught inside a primary bookkeeping scandal who does indirectly cause their collapse 2 yrs after, but zero managers during the insurance policies giant have been prosecuted.

Therefore if three somebody as you own a great 750,000 account, the complete balance is insured since the for each and every depositor’s 250,one hundred thousand show of one’s membership are insured. Around the exact same go out you to Breuer is testifying, although not, a narrative bankrupt one to prior to the pathetically small payment from 75 million your SEC had install that have Citigroup, Khuzami had bought his team to pursue lightweight charge from the megabank’s managers. Just after one, Cassano strolled to the Washington so you can attest before Economic crisis Query Commission.