Have you been likely to purchase a property? In this case, then it’s important to has a definite and you may detailed information of the home loan processes, that’s generally split up into step 3 grade, we.age., application, financing approve, and you may disbursal. Around most of these stages, mortgage approve is an important that since this is new phase where in actuality the financing was often accepted or refused. Pursuing the mortgage software process begins, https://cashadvanceamerica.net/payday-loans-ut/ the financial institution verifies the brand new records of the candidate and you may tends to make a good choice in order to accept otherwise refute the mortgage. The mortgage is eligible in the event that and only should your given standards try met flawlessly. Because the mortgage is approved, the lending company commonly situation a beneficial Sanction Letter, that is evidence you are qualified to receive your house mortgage.

So, or even know far on the approve letter as well as part obtaining home financing, next this informative guide is actually for you! Read till the stop to own a far greater understanding of the subject.

What’s a great Sanction Page?

A Approve Letter the most important records inside the our home loan process. Regardless of whether you’re taking a loan to own building a good huge house otherwise a little family, Approve Letter plays a significant role all the time. A great Sanction Page is actually a document available with the fresh financing financial facilities or bank towards the debtor. Which document claims your home loan could have been accepted. As well, it contains this new small print on the basis of and this the borrowed funds might be offered to the fresh applicant.

Because candidate gets the financial Sanction Page, the bank or financial institution delivers an authorized provide page bringing-up the important facts related to the house loan. New applicant will be expected to sign the fresh anticipate backup and you may submit they to the lending company otherwise lender. At this time, you need to look at every piece of information considering on the Sanction Letter very carefully and you will comprehend the fine print.

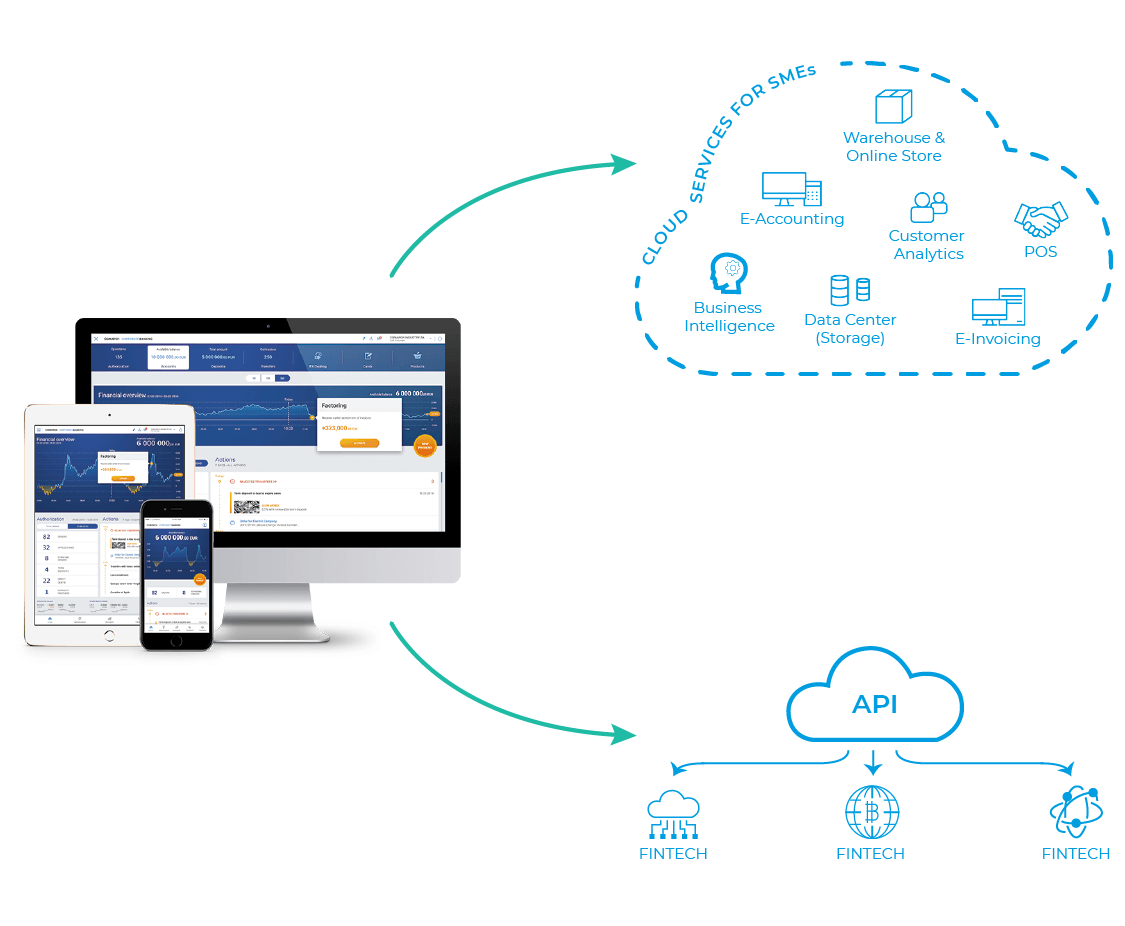

At this time, the home application for the loan techniques has been basic, with many financial institutions and you will banks giving electronic methods to put on for an age-financial. They furthermore expand the ability to score an electronic Financial Approve Page. Since the term suggests, an electronic digital Home loan Sanction Letter is actually an electronic form of your house loan recognition document that bank points before delivering the past financial contract on applicant.

Data files Needed for the house mortgage Sanction Letter

A financial or financial institution often charge you certain records getting registered in advance of giving a approve page. The brand new data may cover:

Exactly how try Approve Letter not the same as Inside the-Idea Approval and you will Disbursement Letter?

Many people usually confuse good Sanction Page with in-Concept Acceptance and you may Disbursement Page, however they are various different in reality. Inside part, we shall clear out the difference between the two.

In-Principle Acceptance refers to the techniques whereby the financial institution assesses the economic standing of the candidate and provide an in-Principle Acceptance page. This letter claims that lender will give the loan, at the mercy of the newest successful confirmation of one’s data files. As a whole, lenders provide the During the-Idea Recognition letters to own pre-accepted fund. Better yet, nonetheless they cost you that is later modified inside the the complete financing control charge. The brand new validity of your own letter selections out of 3 to 6 days, with respect to the lender.

Having said that, an excellent Approve Page getting home financing is a proper file saying that you have getting eligible to acquire the particular amount borrowed. This new fine print made in brand new page continue to be good right until the brand new go out specified in the letter. It is vital to keep in mind that this new loan company could possibly offer the initial terms applied otherwise can alter them for the base of the loan qualifications of the candidate.

+ There are no comments

Add yours