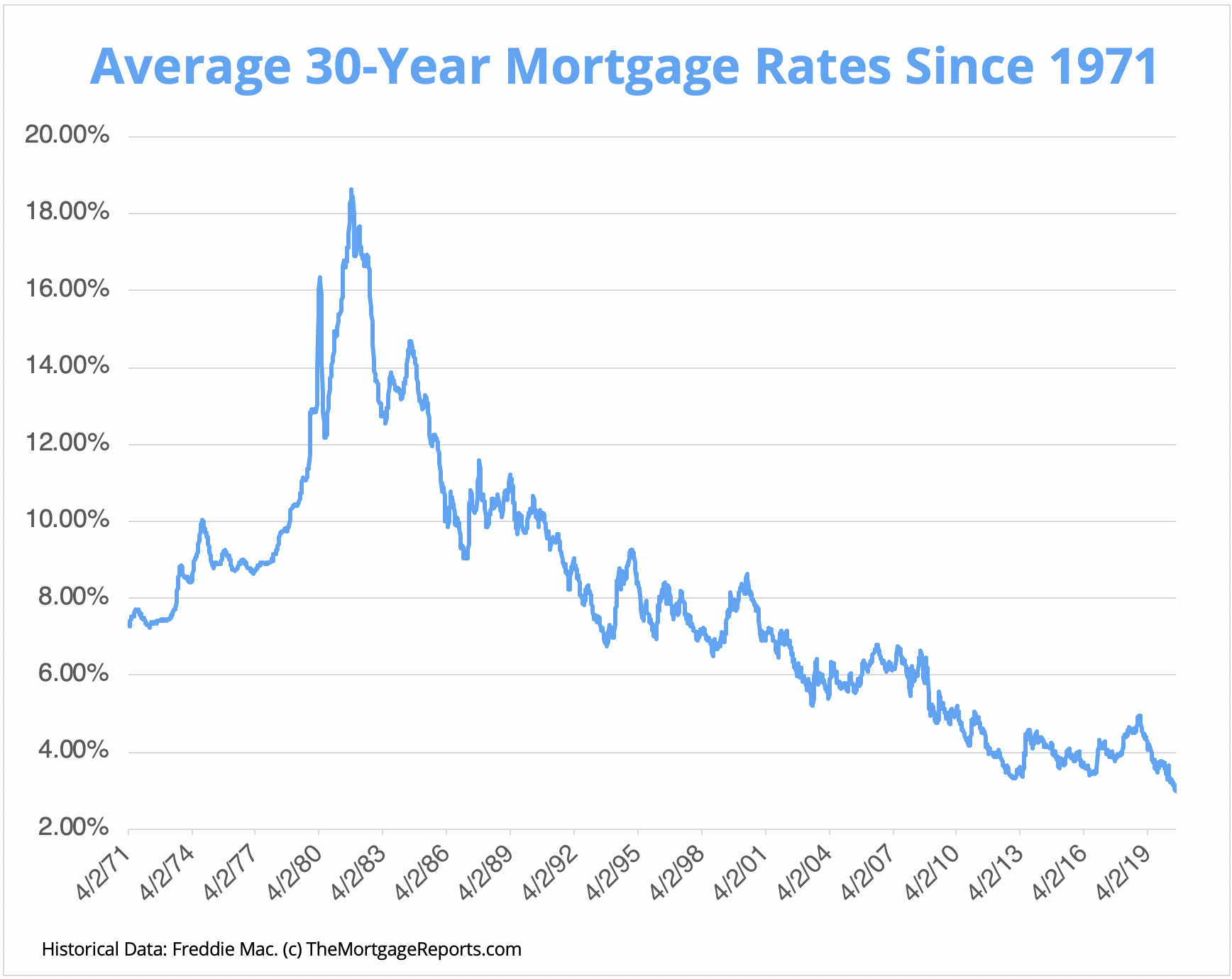

- A home loan could be the biggest financial commitment you’ll have, it almost certainly requires a bigger percentage of their monthly money. But since it is currently dispersed over many years, it could foundation less than carrying highest balances in other personal debt versions (for example credit cards).

- Holding one or more home loan is achievable if you possess the money or collateral so you’re able to meet the requirements (including, if you have an investment property otherwise next home loan).

Instalment Debt

Secured. Monthly-payment matter. A vehicle financing was a typical example of that it obligations-types of. The fresh new repaired money (generally speaking in for step one – 8 many years) will be easier to budget up to than just rotating credit (in which monthly repayment is climb up from inside the a brief period of your time). Lenders often determine your debt-provider percentages with your repaired percentage amounts in lieu of factoring inside the whole loan equilibrium.

- Instalment money constantly get less time to repay as compared to financial debt, however, they’re still an extended-identity relationship (imagine month-to-month cash flow!).

- Whenever including this type of debt, allow it to be room enough to other costs or obligations that can become collectively.

- While the instalment obligations costs are often an identical monthly, they truly are better to do (than the revolving borrowing).

HELOC Personal debt

Revolving, Safeguarded. Whole harmony. Distinct from a credit line (LOC), which is unsecured and usually deal a high rate of interest – the majority of people have fun with a home Security Personal line of credit (HELOC) to help you combine large-appeal obligations, or even for big expenses, for example domestic home improvements. This type of loans are calculated out eg home financing, unlike a portion of the balance.

- A beneficial HELOC was safeguarded by the house and you may, thus, is far more versatile and less weighted for the pre-approval than just an enthusiastic unsecured LOC.

- However,, this form is still ‘revolving,’ meaning that the bill will be improved at your discretion and you can really influences your debt provider percentages.

Figuratively speaking

Entire harmony. When you yourself have pending or effective student money, lenders estimate part of the whole balance to your month-to-month debt load. Typically, student loans hold straight down interest and a lot more flexible payback schedules and you may try quicker ‘weighted’ compared to, state, personal credit card debt.

Spousal or Youngster Assistance Repayments

Monthly-fee amount. Lenders factor these costs into the loans services proportion when you’re spending. While you are finding these repayments, a portion is placed into your own monthly income.

Eventually, the way you control your loans is mirrored on the credit rating, and you can in person has an effect on your overall month-to-month financial obligation services (debt-to-income) ratios, both of which loan providers used to be considered your.

Whatever the financial obligation you’ve got, being reasonable along with your income and you will finances will help you keep up uniform costs having a more powerful credit image. And extended you could inform you good payday loans online Tennessee history of paying your debt, the easier it will be to really get your prominent bank, otherwise an amount greatest rate, on-board.

Exactly how loan providers remove the debt shall be challenging. But we create easy to understand.

Looking to buy a property? The incredible Genuine Northern Lenders makes it possible to along with the debt inquiries – on your well-known code – and can rapidly process your own pre-approval which means you know precisely where you’re and you may hence financial will be your best match.

Consider the debt with experts who care.

Irrespective of the debt sizes, we can help you types it and acquire an educated technique for home loan pre-acceptance when you find yourself buying your first house, or you need option lenders during the revival or re-finance for additional funds.

+ There are no comments

Add yours