Understand everything about taking a great subprime mortgage within our publication. We experience exactly what a subprime mortgage are, the pros and drawbacks, what you should think, just how to implement and.

Want to know Significantly more?

Fill out this form and we’ll contact you so you can book a free example which have one of our home loan advisers.

You have got see the term subprime home loan, exactly what just is it? A beneficial subprime financial was a loan provided by a loan provider you to definitely actually your own practical high-street lender but typically a detrimental borrowing or specialist bank. If you are considering a beneficial subprime home loan, you should know very well what these types of loan entails. In this publication, i discuss the concept of an effective subprime financial, advantages and you can disadvantages and the ways to have one.

The newest Information Protected in this article Are as follows:

- What exactly is an effective Subprime Financial?

- Which are the Benefits and drawbacks from Subprime Mortgage loans?

- Whenever Do i need to Consider Applying for a Subprime Home loan?

- What can Affect My Eligibility for an excellent Subprime Mortgage?

- Who will be Subprime Lenders?

- Do i need to Safer a Subprime Financial?

- What things to Imagine Before you apply getting a Subprime Financial?

- How do i Boost My Possibility of Protecting a great Subprime Mortgage?

- Must i Rating good Subprime Mortgage to have Industrial Site?

- How do i Submit an application for a Subprime Financial?

What’s good Subprime Financial?

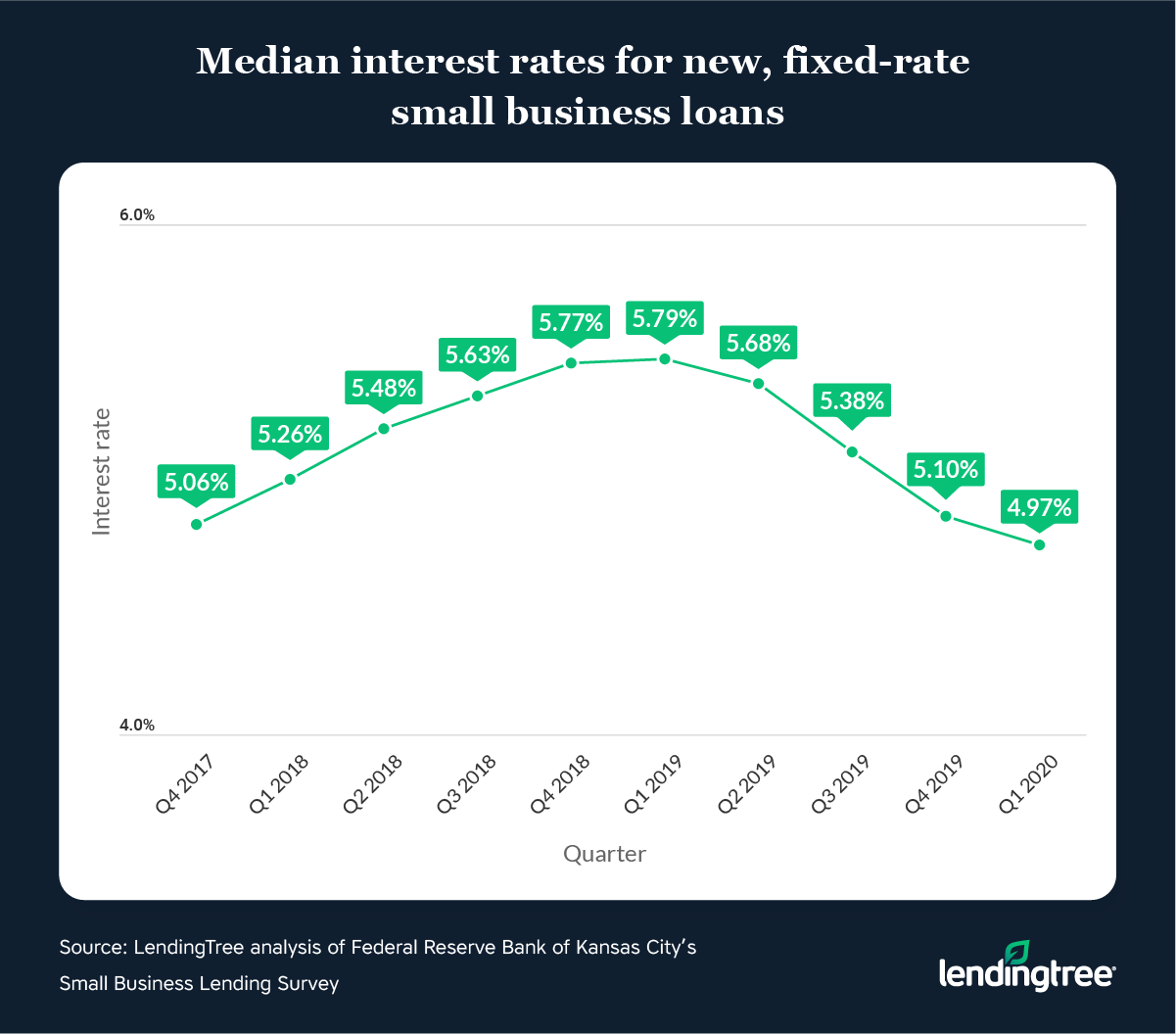

An effective subprime home loan are a loan that people that have adverse credit rating. This might become that have CCJs (condition court judgments) loans in Severance, poor credit, non-payments and you may a bad reputation of borrowing administration. These types of mortgages usually feature highest interest rates than simply normal mortgage loans, have a tendency to throughout the 2% over the common cost. Specific subprime lenders require also at least 15% from inside the deposit.

Subprime loan providers evaluate software privately if you take under consideration each person’s private circumstances – along with why they have adverse credit, how current its and exactly what led to they. Their purpose is to give responsibly to make sure borrowers pays straight back the loans if you are offering anybody the opportunity to availableness a financial whenever high-street loan providers won’t consider them.

The advantage of good subprime mortgage is that it will bring individuals with unfavorable credit records access to a home loan, that they may not be capable of if you don’t. It means they could pick a house otherwise an investment property and start strengthening collateral though they will have made certain monetary mistakes prior to now.

Although not, it is vital to know the prospective drawbacks as well. Subprime mortgages usually feature high interest levels and you will quicker LTV/loan amount caps, meaning new debtor would have to generate so much more sacrifices in terms of the monthly premiums and perhaps its existence. Luckily for us that this would be reviewed throughout the coming because of the remortgaging to a better speed once you have mainly based upwards a better credit rating.

Whenever Can i Thought Making an application for an excellent Subprime Home loan?

If you’re looking to shop for another type of family but don’t qualify having a traditional mortgage, subprime mortgages might possibly be a simple solution for you. Though these funds have highest rates of interest than just old-fashioned mortgages of high-street loan providers otherwise strengthening communities, they are able to help match the economic conditions of individuals who won’t if you don’t have the ability to purchase a house. Definitely, you ought not apply for a subprime mortgage in the place of given its money together with prospective consequences.

So, when if you think of trying to get good subprime financing? Essentially, it is best to look at this if you want more hours so you can develop your credit rating or if perhaps you have experienced economic difficulties before which have sooner altered your credit history. Subprime loan providers know about your credit report and money and do not credit assessment regarding old-fashioned method when contrasting loan requests, to enable them to help consumers with less epic credit histories secure mortgage loans. As well, certain subprime loan providers need consumers no lowest credit rating after all which makes them a stylish choice for people with limited borrowing from the bank sense or with no form of based credit score.

+ There are no comments

Add yours