Just how HOLC Rated Home loan Risk

Certainly Roosevelt’s first steps to improve mortgages would be americash loans Long Hill to sign guidelines to manufacture our home Owners’ Financing Organization (HOLC) in 1933. Historians Todd Michney and you can LaDale Winling establish exactly how HOLC had several type of phases, and therefore reshapes exactly how we comprehend the role of its redlining charts. And with this 2nd stage, HOLC released their Town Questionnaire Program and you can sent community representatives so you can interviews local lenders and you can harvest society risk appraisals to your Domestic Cover Charts to own 239 towns and cities nationwide. However, HOLC don’t invent redlining, once the life insurance people prior to now discriminated such as this, nor performed HOLC disperse its charts past a little set of government officials. Believe it or not, as we name such redlining charts today, historians Michney and you will Winling highlight you to HOLC never ever put so it place of maps in order to redline otherwise reject that loan to help you some body, just like the agency’s very first maps weren’t offered up until late 1935, shortly after HOLC produced nearly all of the citizen loans through the their rescue phase. 19

While in the their help save stage regarding 1933-thirty-five, HOLC made-over 97 per cent of their fund by purchasing and you will refinancing mortgages to have home owners against bank foreclosure and their failure to keep up with costs during the Depression

How come these types of charts amount? Regardless of if HOLC maps didn’t end up in redlining, it clearly mirror the fresh new racist and you can elitist perspectives of your federal officials whom written them, and therefore vivid reflection lasted regarding archives to your establish date. In comparison, the Government Casing Government (FHA) arrived at create its own color-coded Neighborhood Reviews Maps inside the 1935, and you may utilized these to deny financial insurance policies apps inside the town neighborhoods. However, government directors appear to disposed of all the damning proof of these FHA redlining maps, as the not totally all of them remain on archives. Based on historians just who remodeled how this type of competition government businesses work, the thriving HOLC maps most likely echo this new opinions of the shed FHA redlining maps. 20

In Hartford, looking closely during the how government agents created HOLC redlining charts within the consultation which have local loan providers suggests the racist and you will elitist opinions of neighborhoods over the growing city-suburban part. Foster Milliken Jr., the fresh new HOLC community broker allotted to this new Hartford town, was no complete stranger to everyone out of loans. Decades earlier, their dad presided over Milliken Brothers, Inc., a multi-mil money structural steel brand name into the Nyc you to definitely founded this new earth’s highest buildings during the time. Ahead of the Anxiety, Promote Milliken Jr. has worked just like the a stockbroker into the New york and you can try accustomed its societal sectors. When HOLC earliest sent him to Hartford within the 1936, he consulted which have a property board people and you will banking professionals, particularly frontrunners of your Area having Coupons, the new country’s eldest common deals financial therefore the city’s best home loan financial. When you are Milliken demonstrated these dudes given that a reasonable and you can ingredient advice of the finest licensed residents, their private report branded Hartford since a greattypical The newest England area which have ultra-conservative financing policies. Hartford bankers need to solve their particular troubles in place of exterior let or guidance, the guy observed, and you can that isn’t stunning that FHA are frowned-upon just as is actually the latest HOLC. 21

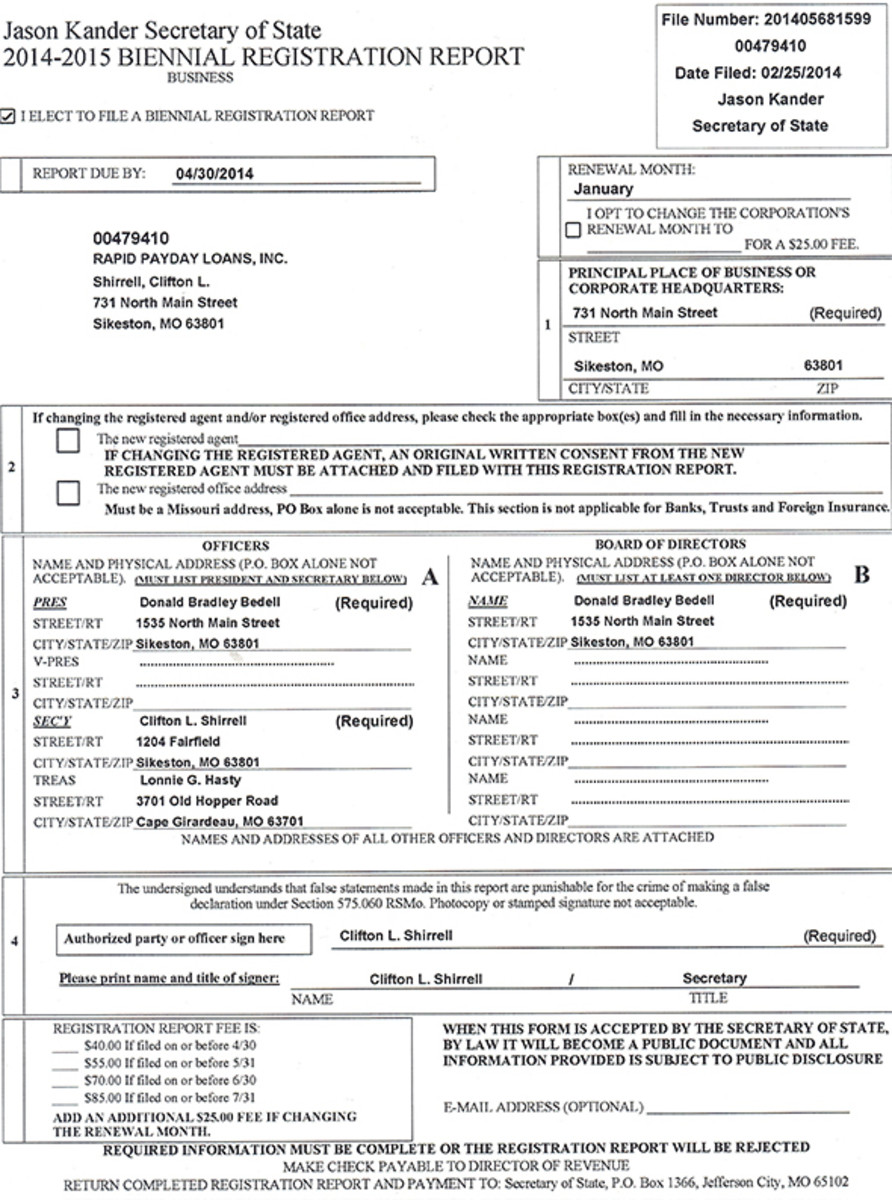

Even after bankers’ distrust with the FDR’s house lending applications, Milliken persuaded multiple professionals to speak actually that have him and provide the candid review out of neighborhoods in town regarding Hartford and you may a couple of suburbs, West Hartford and you will East Hartford. Milliken’s declaration captured their collective feedback of your own trend from desirability for each urban area, accompanied by this new five-colour HOLC Domestic Defense Chart in order to aesthetically illustrate the detected levels of home loan financial support exposure. Environmentally friendly signaled the newest easiest elements to possess lenders to provide home loans, followed closely by bluish and you may yellow, after which yellow noted the absolute most hazardous portion about what is well known now given that Hartford-city redlining chart, while the found when you look at the Shape dos.cuatro. twenty-two

+ There are no comments

Add yours