Like: As a result if for example the home loan obligations towards an effective $two hundred,000 house is $165,000 (or $130,000 to possess a married couple), their collateral could be $thirty five,000 ($70,000 to possess a wedded partners), and you will will be protected by the brand new homestead exception to this rule. In this analogy, your residence might be secure. If at all possible, you may be latest otherwise alongside latest on the home loan money and other bills particularly homeowner’s insurance policies and you can possessions taxes into the purchase so you can file for Chapter 7 bankruptcy. This is because Chapter 7 cannot help a borrower with financial delinquency otherwise assets income tax delinquency.

Chapter 13 bankruptcy proceeding is generally a much better choice if you aren’t able to catch-up on your own payments. This style of case of bankruptcy provides a cost plan, which may allow you to make skipped costs over time collectively together with your normal monthly premiums. Including, when you yourself have low-exempt equity on possessions youre however allowed to hold you to definitely in the Chapter 13.

Covered Loans versus. Liens

A secured financial obligation lets a collector when deciding to take an excellent borrower’s property if your personal debt is not paid off. Credit cards and power bills is actually personal debt until this new creditor obtains a wisdom contrary to the borrower whereby one to wisdom could possibly get do good lien for the houses. Mortgage loans was secure personal debt. If you fail to spend their mortgage, a collector can foreclose on the family.

A good lien can also provide a lienholder the legal right to be paid before almost every other creditors in no credit check payday loans New Site AL the personal bankruptcy. If a great trustee in a section eight circumstances deal property that have good lien in it, they could need to pay a secured collector in advance of they spend other creditors. If the there are multiple liens on the property, the first lien was paid down first.

Do i need to Pay My Financial If i Document Section eight Personal bankruptcy?

Yes, you nevertheless still need and then make your own mortgage payments for individuals who document getting bankruptcy proceeding. Preferably, would certainly be current or alongside latest in your mortgage just before declaring A bankruptcy proceeding personal bankruptcy.

If you aren’t latest in your money but they are together with not past an acceptable limit at the rear of, you happen to be capable catch-up on the back money and also make your own typical payments, nonetheless file A bankruptcy proceeding. Section 13 personal bankruptcy takes lengthened, it may are better for your requirements if you would like a whole lot more time and energy to catch-up.

Case of bankruptcy can be relieve your of the obligations on the household, yet not out-of a home loan lien which enables the collector to foreclose. For those who file for bankruptcy and do not make your mortgage money, you may still reduce your home.

Should i Score home financing Immediately after Personal bankruptcy?

Sure. Personal bankruptcy does not have to keep your back for a long day. Normally, make an effort to hold off 2 yrs after their personal bankruptcy discharges before you could rating a conventional mortgage loan. Remember that the discharge day is not necessarily the time you registered for bankruptcy proceeding. It can take 4-6 months or longer, dependent on if for example the possessions is actually protected, for a bankruptcy proceeding to discharge.

Whenever taking a separate mortgage, you should check your own credit reports to ensure that the released financial obligation enjoys most of the come used in your own case of bankruptcy. Getting pre-entitled to financing will save you difficulties as well and you can makes the method simpler. You can also get a national Housing Administration (FHA)-supported mortgage, nevertheless wishing months is generally longer than a regular loan, according to the credit institution’s criteria.

Ought i Explore an opposing Financial in Filing Chapter 7 Bankruptcy?

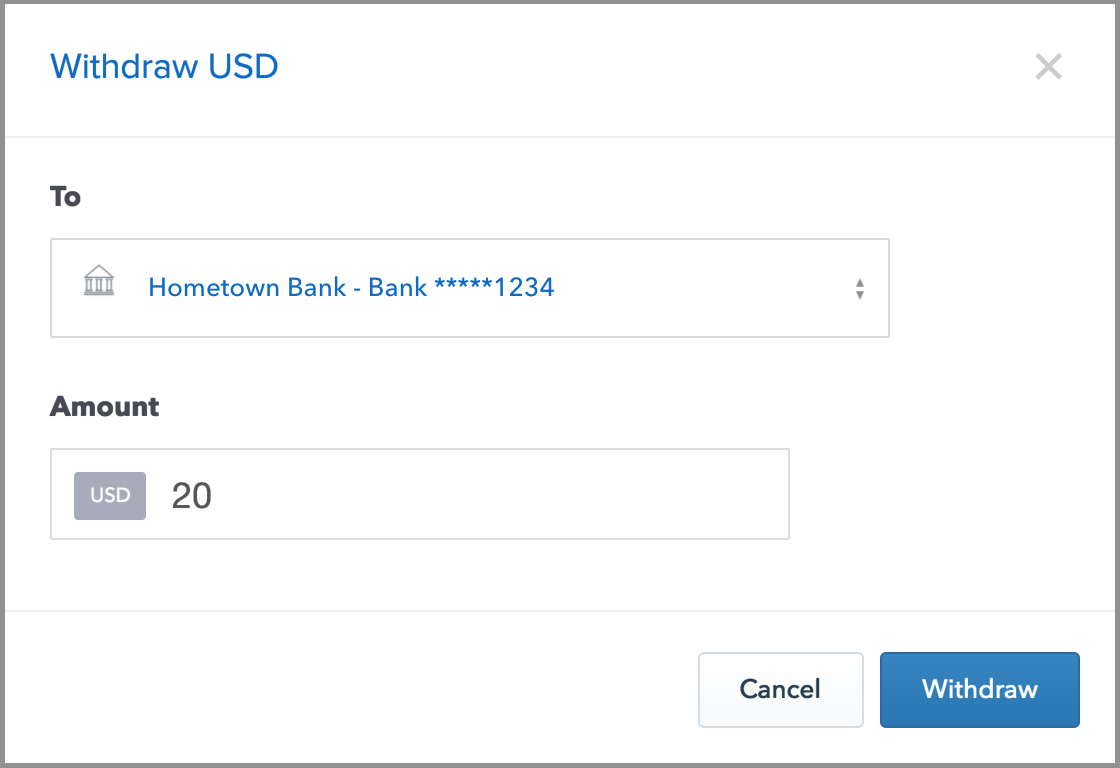

If you are 62 years old otherwise elderly, you might be eligible for a reverse mortgage, that’s a loan with the guarantee of your property because of where one can found financing for the a lump sum, within the normal monthly installments, otherwise with a personal line of credit.

+ There are no comments

Add yours